WHY DO BUSINESS IN WISE COUNTY?

- Loyal customers

- Access to professional services like banks, accountants, real estate, title services

- Reliable, high speed Internet availability

- Affordable real estate and low real estate tax rate of $0.69 per $100 of assessed value to keep your costs low

- No business license requirements or business tax imposed by Wise County

- Wise County’s Building & Zoning department can review and approve building permits quickly, so you can open your doors for business sooner

- Strategic location within one day’s drive of 70% of the U.S. population

- Quality and customizable workforce training programs exist at two local colleges, Mountain Empire Community College and UVA-Wise to help equip your employees with the right skills for the job

- The work ethic in Wise County is second to none

THINGS TO CONSIDER WHEN YOU’RE GETTING STARTED

- Am I willing to make the needed commitment of my time and money to make this business a success?

- Do I have the skills to operate this business?

- How well do I know my product/service, and is there a market for my product/service?

- Do I have a written business plan?

STEPS FOR SUCCESS

- Make an appointment with the Virginia Small Business Development Center for free consulting, affordable training courses, personal referrals to local resources, guidance, insights, and connections to help your business succeed. Learn more about Wise County’s SBDC located at Mountain Empire Community college.

- Determine your best type of business structure – Sole Proprietorship, Partnership, or Corporation.

- Write your business plan.

- If your business is a partnership, draw up a partnership agreement.

- If you are planning a corporation, file Articles of Incorporation. For more information on Articles of Incorporation, speak to a local attorney.

- Obtain federal, state, and local forms if you employ one or more people (e.g., Worker’s Compensation, Unemployment Compensation, Federal Income Tax Withholding, State Income Tax Withholding, and Social Security Taxes)

- Get an accountant or accounting software.

- Determine the location of your business.

- Check with the Wise County Building & Zoning Department concerning zoning requirements. The Town of Big Stone Gap and the City of Norton have their own Building & Zoning Departments.

- If your business is located within town limits, check with the local treasurer about business license/tax requirements. The County of Wise imposes no business license requirement or business tax.

GOVERNMENT/REGULATORY STEPS TO OPENING A BUSINESS

- If a Limited Liability Company or a Corporation, register articles of organization with the Virginia State Corporation Commission.

- Register with the Internal Revenue Services for Employer Identification Number.

- Register the business with the Virginia Department of Revenue for tax purposes. If you plan to hire employees, register the business with the Virginia Employment Commission – this can be done at the same time you register your business with Virginia Tax.

- Register with the State Corporation Commission.

Restaurants/Retail

- Restaurants and retail stores selling alcohol must contact the Virginia Alcohol Beverage Commission.

- Food stores must apply for a permit from the Virginia Department of Health.

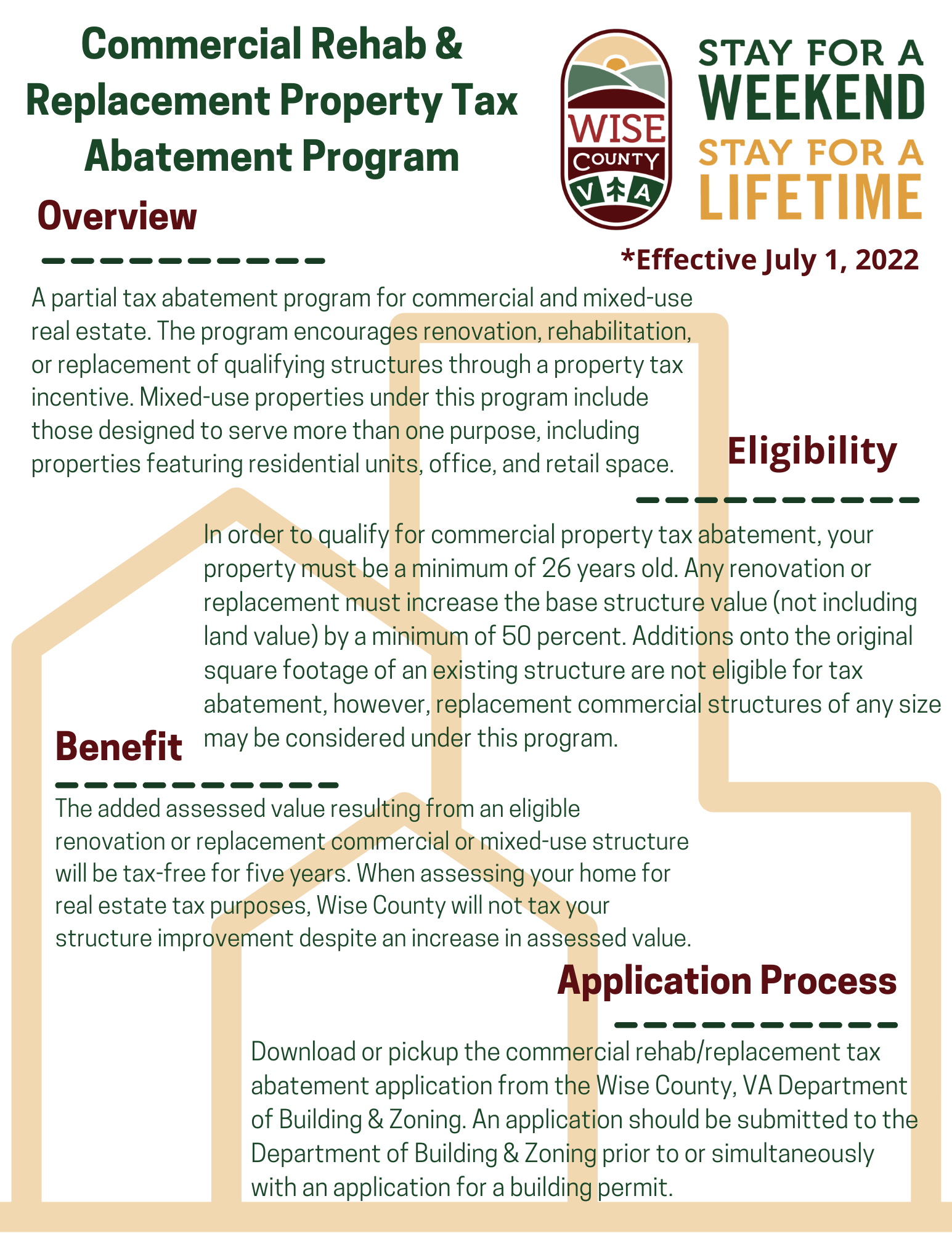

Commercial Rehab & Replacement Tax Incentive (Application Available July 1, 2022)